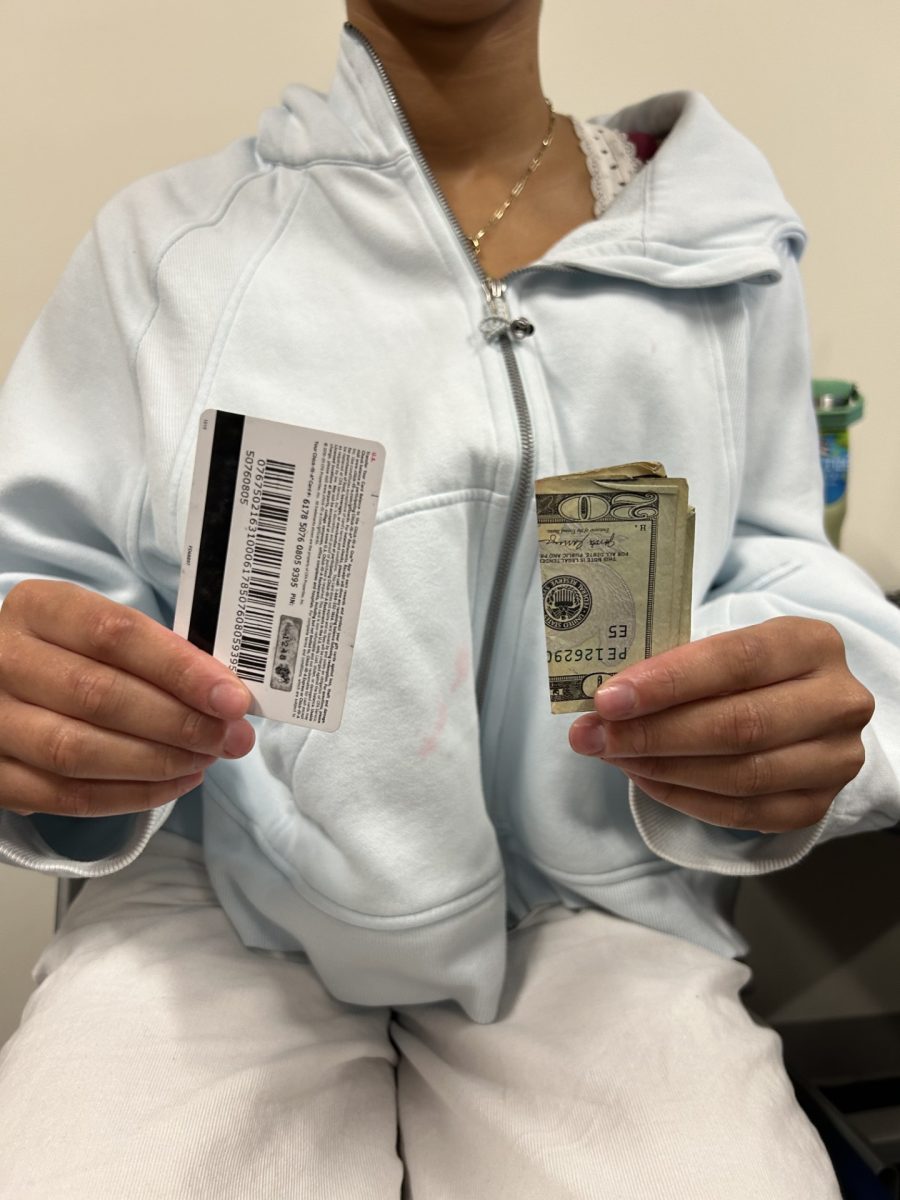

As technology is continuously advancing, electronic banking and payments have become the most popular payment method. Instead of carrying cash or change with them into stores, consumers have started to pay with a card or even through phones, as it is faster than paying with cash. While on the other hand, having cash can help with payment emergencies or spending control. This makes people question, is it better to pay by cash or card?

Rob Metts (9) would rather pay with cash more than card. He says he thinks cash is safer due to hackers in electronic banking.

“I use cash more than a card because cash is easier to use than a card. Cash is an older way of paying for things and I haven’t switched to a new way yet, which would be card. Electronic banking can also be bad because it might be easier to hack them,” Metts said.

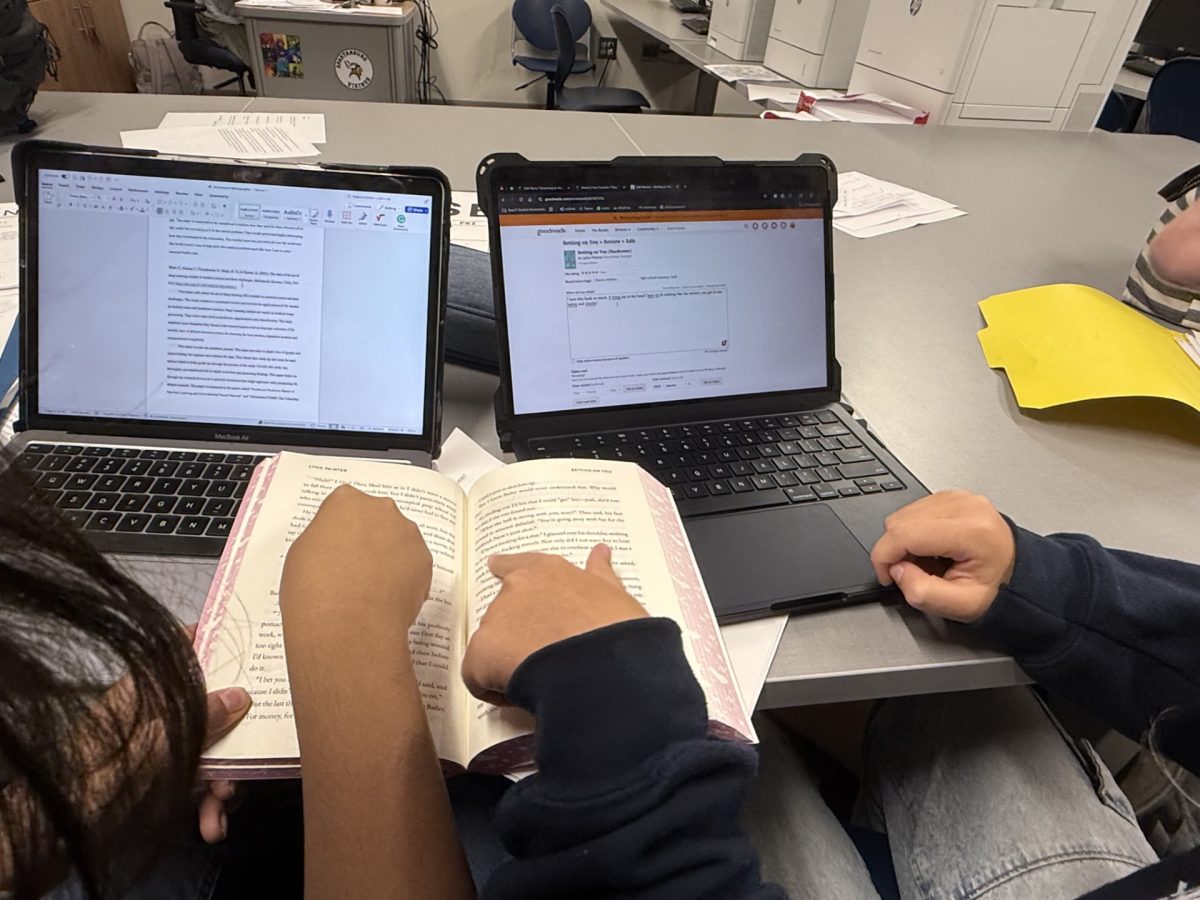

There is no doubt the world is dependent on electricity, and it is changing the way people control their money. With the growth in online shopping, customers easily spend more than they realize or even want to because of electronic money. Having cash on hand makes people question every purchase unlike electronic money, where the money may seem endless. Paying by card or through electronic banking can help with speed of transactions, which is why it is a popular payment method; as well as enhancing security with almost every purchase, electronic banking is constantly changing the future of how people spend.

Anna Evans (10) pays by card more than cash because of its accessibility, and she says she thinks cash is going to become unpopular.

“I usually pay with card more because it is easier to carry one card than bills or coins. I think more people are going to continue to use less and less cash because of how easy it is to use cards,” Evans said.

A cashless system is slowly becoming a new reality in society. Change and cash have been used since the 7th century B.C. and still plays a crucial role in today’s economy. While the newer generations are comfortable with using online banking to pay, most elders in society are often not confident in the idea. According to which.co.uk, if the UK went cashless, almost 50 percent of the population would struggle with the change. The cost to make a cashless world happen is significant, which is another reason this idea has been held back. Updating technology, privacy and security to have a cashless economy would burden businesses and governments around the globe. So even though the use of cash is dwindling, it’s not done for good…yet.

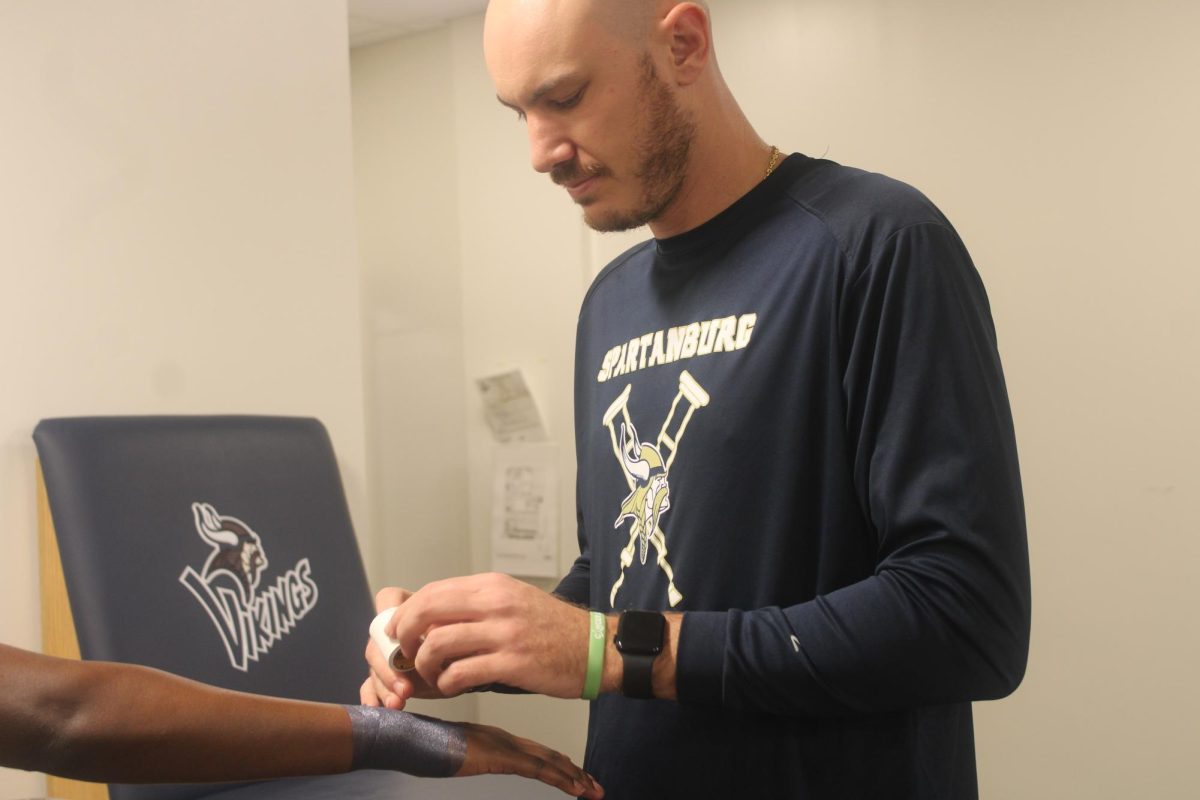

Jesse Dyar, personal finance teacher and baseball coach at Spartanburg High School, says he thinks a cashless system could negatively affect the world when in emergencies, as well as stating that payments with cash can affect consumerism.

“Managing personal finances online makes it easier for more people to reach it since almost all adults now have access to the internet and phones to create, check, and manage the bank accounts,” Dyar said. “Using a cashless system definitely affects consumers in their purchases. Having a card or a phone on hand makes it so easy to purchase items that are not needed.”